33

| 33 | ||

| Preliminary Proxy Statement | ||||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| Definitive Proxy Statement | ||||

| Definitive Additional Materials | ||||

| Soliciting Material Pursuant to §240.14a-12 | ||||

|

|

| No fee required. | ||||

| £ | Fee paid previously with preliminary materials. | ||||

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

|

| ||

|

|

By order of the Board of Directors

Charles D. Vogt

President and Chief Executive Officer

| By order of the Board of Directors | |||||

| |||||

| Charles D. Vogt | |||||

| President and Chief Executive Officer | |||||

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON,

PLEASE VOTE YOUR SHARES BY PHONE, VIA THE INTERNET, OR, IF YOU RECEIVED PAPER COPIES OF THESE PROXY MATERIALS, BY COMPLETING, SIGNING, DATING AND RETURNING THE ENCLOSED PROXY CARD AT YOUR EARLIEST CONVENIENCE.

17, 2023

| YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE VOTE YOUR SHARES BY PHONE, VIA THE INTERNET, OR, IF YOU RECEIVED PAPER COPIES OF THESE PROXY MATERIALS, BY COMPLETING, SIGNING, DATING AND RETURNING THE ENCLOSED PROXY CARD AT YOUR EARLIEST CONVENIENCE. | ||

May 30, 2023

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

17, 2023.

|

| |

|

| |

|

|

|

|

| ||||||

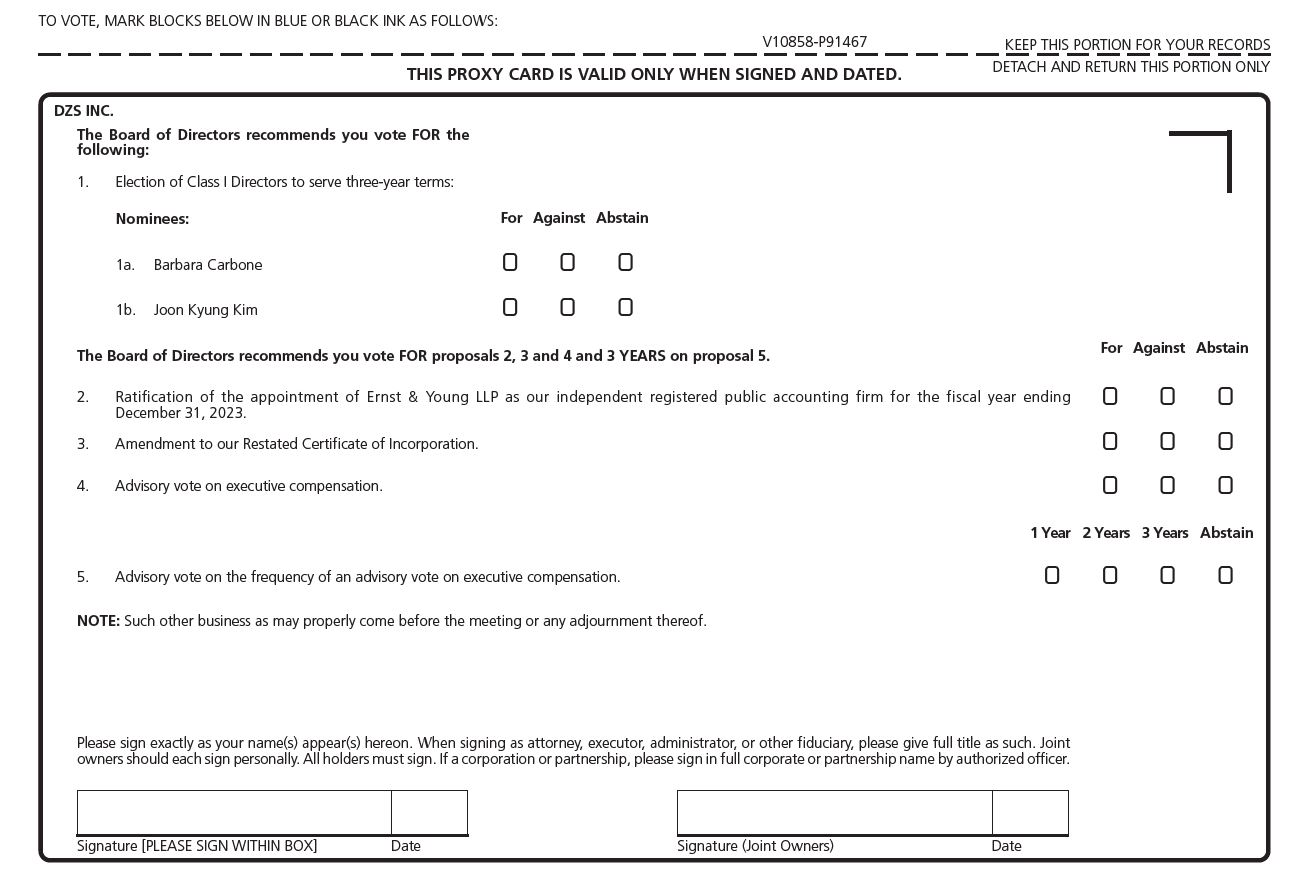

Proposal | Recommendation | Page Reference | ||||||

| 1 – Election of the Class | FOR |

| ||||||

2 – Ratification of Ernst & Young LLP as our independent registered public accounting firm | FOR |

| ||||||

| 3 – Approval of Certificate of Amendment to Restated Certificate of Incorporation | FOR | |||||||

| 4 – Advisory Vote on Executive Compensation | FOR | |||||||

| 5 – Advisory Vote on Frequency of Advisory Vote on Executive Compensation | FOR | |||||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

DZSI2023.

Will I Be Able to Ask Questions at the Annual Meeting

Name | Class | Age | Position | Term Expires |

Director Nominees |

|

|

|

|

Min Woo Nam | III | 60 | Chairman of the Board | 2022 |

Charles D. Vogt | III | 58 | President, CEO and Director | 2022 |

|

|

|

|

|

Continuing Directors |

|

|

|

|

Barbara Carbone | I | 63 | Director | 2023 |

Joon Kyung Kim | I | 63 | Director | 2023 |

Matt W. Bross | II | 61 | Director | 2024 |

David Schopp | II | 73 | Lead Independent Director | 2024 |

Choon Yul Yoo | II | 61 | Director | 2024 |

| Name | Class | Age | Position | Term Expires | ||||||||||

| Director Nominees | ||||||||||||||

| Barbara Carbone | I | 64 | Director | 2023 | ||||||||||

| Joon Kyung Kim | I | 64 | Director | 2023 | ||||||||||

| Continuing Directors | ||||||||||||||

| Matt W. Bross | II | 62 | Director | 2024 | ||||||||||

| David Schopp | II | 74 | Lead Independent Director | 2024 | ||||||||||

| Choon Yul Yoo | II | 62 | Director | 2024 | ||||||||||

| Min Woo Nam | III | 61 | Chairman of the Board | 2025 | ||||||||||

| Charles D. Vogt | III | 59 | President, CEO and Director | 2025 | ||||||||||

Min Woo Nam has served as the Chairman of the Board of Directors of DZS since 2016. Mr. Nam currently serves as the Chief Executive Officer and Chairman of the Board of Directors of DNI, a position he has held since March 1993. Mr. Nam previously served as the Chief Executive Officer of Korea Ready System and Dasan Engineering Co., Ltd. His work has included export of technical services to Silicon Valley, California since 1999. Mr. Nam served as General Chairman of the International Network of Korean Entrepreneurs from 2004 until 2006, and has served as Director of the Korea Entrepreneurship Foundation since November 2011. Previously, he served as Chairman of the Korean Venture Business Association. Mr. Nam completed his B.E. in Mechanical Engineering from Seoul National University in 1984. We believe Mr. Nam is well suited to serve as the Chairman of our Board of Directors given his extensive experience serving in chief executive officer and chairman roles and his in-depth knowledge of the telecommunications industry.

Charles D. Vogt joined DZS as President, Chief Executive Officer and as a director in 2020. A lifelong entrepreneur, Mr. Vogt has spent the past two decades building and leading organizations through high growth and rapid change in challenging and competitive environments. Prior to joining the Company, Mr. Vogt was most recently President, Chief Executive Officer and a Director of ATX Networks, a leader in broadband access and media distribution, where he led the company through extensive transformation and growth since February 2018. From July 2013 to January 2018, Mr. Vogt served as President, Chief Executive Officer and a Director of Imagine Communications, where he directed the company through revolutionary change as it evolved its core technology, including large-scale restructuring and rebranding and multiple technology acquisitions as he implemented a disruptive vision and growth strategy. Before joining Imagine Communications, Mr. Vogt was President, Chief Executive Officer and a Director of GENBAND (today known as Ribbon Communications), where he transformed the company from a startup to the industry’s global leader in voice over IP and real-time IP communications solutions. His professional career has also included leadership roles at Taqua (Tekelec), Lucent Technology (Nokia), Ascend Communications (Lucent), ADTRAN, Motorola and IBM. Mr. Vogt is currently a board member for Stryve Foods, Inc. (NASDAQ: SNAX). Mr. Vogt received his B.S. in Economics and Computer Science from

Saint Louis University. We believe Mr. Vogt is well suited to be our Chief Executive Officer and serve on our Board of Directors given his extensive chief executive officer experience, his expertise in the business arena, and his in-depth knowledge of the telecommunications industry.

Continuing Class I Directors with Terms Expiring 2023

Barbara Carbone has served as a director of DZS since January 1, 2021. Ms. Carbone is a recognized business leader and audit partner with deep expertise across the software, media, consumer products, manufacturing and financial spaces. For nearly 40 years, in addition to serving clients, she held several leadership roles at KPMG, including as the leader of a large business unit, the global software practice leader and as the national partner in charge of human resources for the audit practice. Ms. Carbone’s experience transforming businesses through mergers and acquisitions, workforce management, divestitures, spinoffs, IPOs, and navigation of public and private markets has given her a diverse and valuable perspective. She is currently a board member for TrueCar Inc. (NASDAQ: TRUE), Blue Nile,Limoneira, Inc. (NASDAQ: LMNR), Bob’s Discount Furniture and Side by Side Services. She is also a Board of Trustee member of Exploratorium. We believe Ms. Carbone is well suited to serve on our Board of Directors given her extensive experience in financial and accounting matters, her extensive experience in advising other organizations and her experience as a director of a public company.

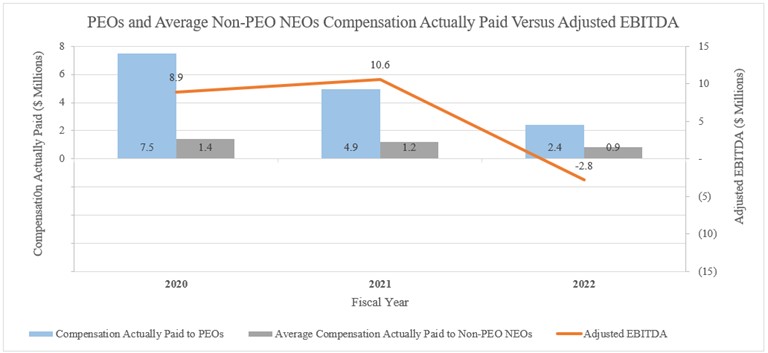

Board Diversity Matrix (as of December 31, 2021) Total Number of Directors 7 Female Male Non-Binary Did Not Disclose Gender Part I: Gender Identity Directors 1 6 Part II: Demographic Background African American or Black Alaskan Native or Native American Asian 3 Hispanic or Latinx Native Hawaiian or Pacific Islander White 1 3 Two or More Races or Ethnicities LGBTQ+ Did Not Disclose Demographic Background Director Independence Financial Expert Audit Committee Compensation Corporate Strategy Committee* Matt W. Bross Independent — — Barbara Carbone Independent — Joon Kyung Kim Independent Min Woo Nam — — — — — David Schopp Independent — — Choon Yul Yoo — — — — — Charles D. Vogt — — — — — Number of Meetings in 2021 9 5 2 0 Company. The Compensation Committee seeks to reward executive officers in a manner consistent with our annual and long-term performance goals, and to recognize individual initiative and achievement among executive officers. Also during the thereto. 2021 Fees 2020 Fees Fee Category Ernst & Young LLP Grant Thornton LLP Audit Fees $1,667,271 $1,312,619 Audit-Related Fees — 5,000 Tax Fees 123,075 — All Other Fees 8,000 — Total $1,798,346 $1,317,619 Name and Principal Position Year Salary ($) Bonus ($) Stock Awards ($) Option Awards ($) (1) Non-Equity Incentive Plan Compensation ($) Change in Pension Value and Non-qualified Deferred Compensation Earnings ($) All Other Compensation ($) Total ($) Charles D. Vogt 2021 550,192 (2) — 4,180,000 (6) — 550,000 (4) — 27,881 (9) 5,308,073 President & CEO 2020 203,173 (3) 446,250 (5) 449,329 (7) 2,964,751 (8) — — 9,325 (10) 4,072,828 Misty Kawecki 2021 126,923 (11) 50,000 (12) 944,000 (13) 1,012,414 (14) 62,500 (4) — 10,488 (15) 2,206,325 CFO 2020 — — — — — — — — Thomas Cancro 2021 202,812 (16) — 418,000 (19) 113,603 (20) 75,000 (4) — 172,801 (21) 982,216 Former CFO 2020 282,019 (17) 66,250 (18) — — — — 63,159 (22) 411,428 Justin K. Ferguson 2021 300,000 (23) — 451,400 (25) 113,741 (27) 150,000 (4) — 32,196 (29) 1,047,337 CLO & Corporate Secretary 2020 82,048 (24) 37,500 (18) 357,000 (26) 190,655 (28) — — 7,049 (30) 674,252 individual executive roles and responsibilities to pursue our short and long-term strategy. In setting executive compensation for 2021, our Compensation Committee engaged Korn Ferry to review our NEOs’ compensation, as well as the mix of elements used to compensate our NEOs, and compared that to a peer group and survey data from global technology companies with revenues of $200 million to $500 million. The Compensation Committee determined that Korn Ferry is independent and that there is no conflict of interest in retaining their services. Based on its review, the Compensation Committee made revisions to our executive compensation program to be more consistent with market practices. Compensation Committee believes that other elements of compensation are more appropriate in light of our stated objectives. This strategy is consistent with our intent of offering compensation that is contingent on the achievement of performance objectives. $325,000, Norman L. Foust $250,000 and Miguel Alonso $235,000. , but, for purposes of the Adjusted EBITDA calculation and taking into account (for 2022 only) the unusual and extreme nature of foreign currency exchange fluctuations during 2022, excluding any impacts as a result of foreign currency exchange fluctuations. ANNUAL BONUS PLAN Target Bonus Metrics ($ in millions) Company Payout Performance Metric Minimum 25% Target 100% Maximum 200% Actual 2021 Results Calculated Payout Weightening First Revenues 68.4 76.0 83.6 81.0 166.0 % 12.5 % Quarter 2021 Adjusted EBITDA (2.9) (2.6) (2.2) 3.6 200.0 % 12.5 % Second Revenues 71.8 79.8 87.8 82.7 136.0 % 12.5 % Quarter 2021 Adjusted EBITDA 2.0 2.2 2.4 (0.4) 0.0 % 12.5 % Third Revenues 78.7 87.4 96.1 88.4 111.0 % 12.5 % Quarter 2021 Adjusted EBITDA 5.6 6.2 6.8 5.1 0.0 % 12.5 % Fourth Revenues 81.3 90.3 99.3 98.1 196.0 % 12.5 % Quarter 2021 Adjusted EBITDA 7.9 8.8 9.7 2.5 0.0 % 12.5 % Total Year 2021 Revenues 300.2 333.5 366.8 350.2 150.0 % 50.0 % Adjusted EBITDA 12.6 14.6 16.7 10.8 Rift Acquisition impact on EBITDA 3.8 Normalized Adjusted EBITDA 14.6 100.0 % 50.0 % Total Weighted Payout Normalized for Acquisition of Rift 125.0 % Executive Officer Total Received under the DZS Misty Kawecki Justin K. Ferguson Alonso participated in this exchange. Option Awards (1) Stock Awards Name Number of Securities Underlying Unexercised Options (#) Exercisable Number of Securities Underlying Unexercised Options (#) Unexercisable Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) Option Exercise Price ($) Option Expiration Date Number of shares or units of stock that have not vested (#) Market value of shares or units of stock that have not vested ($) Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#) Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($) Charles D. Vogt 65,842 (2 ) 452,676 (2 ) — 10.11 08/01/30 — — 229,630 (3 ) 3,724,599 Misty Kawecki — 100,000 (4 ) — 18.88 08/02/31 — — 50,000 (5 ) 811,000 Justin K. Ferguson 15,623 (6 ) 21,877 (6 ) — 9.52 09/28/30 — — 55,000 (8 ) 892,100 — 10,000 (7 ) — 20.90 07/01/31 — — — — Under the Kawecki Employment Agreement, Ms. Kawecki will receive certain compensation in the event that she resigns for “good reason” or her employment is terminated by the Company for any reason other than by reason of death, disability or “cause” (each, a “Qualifying Termination”). In the event Ms. Kawecki’s employment is terminated by reason of a Qualifying Termination, Ms. Kawecki will be entitled to receive (i) her base salary through the date of termination, reimbursable business expenses in accordance with company policies, and any accrued, vested benefits, in each case to the extent not previously paid, (ii) a lump-sum payment equal to the greater of (A) Ms. Kawecki’s annual salary as in effect immediately prior to the date of termination or (B) $300,000, and (iii) Ms. Kawecki’s bonus for the quarter in which the termination occurs based on actual Company performance. Vesting of the equity awards will be immediately accelerated if Ms. Kawecki resigns for “good reason” (as defined below) or her employment is terminated by the Company for any reason other than by reason of death, disability or “cause” (as defined below), within twelve months following a change in control. Future equity grants will be made at the discretion of the Board of Directors. Mr. Ferguson’s base salary was increased to $325,000 effective January 1, 2022. Board of Directors. officers. Additionally, Mr. Alonso will receive relocation assistance to move from California to Texas. In Under the performance, pro-rated for the number of days actually worked in the quarter, (iv) payment of the cost of COBRA continuation coverage for six months, and (v) vesting of all equity awards will be immediately accelerated. continuation coverage for six months, and (v) vesting of all equity awards will be immediately accelerated. and Offer Letters Directors or the Chief Executive Officer. Plan Category Number of securities to be issued upon exercise of outstanding options, warrants, and rights (1) Weighted average exercise price of outstanding options, warrants and rights Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column) Equity compensation plans approved by security holders 2,767,552 (1) $ 7.41 1,264,983 (2) Equity compensation plans not approved by security holders 518,518 (3) $ 10.11 — Name Fees Earned or Paid in Cash ($) Stock Awards ($) (3) Option Awards ($) Non-Equity Incentive Plan Compensation ($) Nonqualified Deferred Compensation Earnings ($) All Other Compensation ($) Total ($) Min Woo Nam (2) 35,000 65,000 — — — — 100,000 Matt W. Bross (1) 50,000 65,000 — — — — 115,000 Barbara Carbone (1) 60,000 65,000 — — — — 125,000 Joon Kyung Kim (1) 65,000 65,000 — — — — 130,000 David Schopp (1) 55,000 65,000 — — — — 120,000 Choon Yul Yoo (1) 35,000 65,000 — — — — 100,000 Name of Beneficial Owner (1) Number of Shares Beneficially Owned (2) Percent Owned (3) DASAN Networks, Inc. (4) 10,093,015 36.6 % AIGH Capital Management, LLC (5) 1,568,344 5.7 % Charles D. Vogt 96,438 (6) * Min Woo Nam 44,043 (7) * Matt W. Bross 5,247 (8) * Barbara Carbone 5,247 (9) * Joon Kyung Kim 12,428 (10) * David Schopp 19,712 (11) * Choon Yul Yoo 15,107 (12) * Other named executive officers: Misty Kawecki — — Justin K. Ferguson 28,249 (13) * All directors, named executive officers and their affiliates as a group (9 persons) 226,471 * 2022, the Company recorded revenues of $1.7 million related to the sales to DNI. year ended December 31, 2022, license related expense was $0.7 million. 2022.Min Woo Nam has served as the Chairman of the Board of Directors of DZS since 2016. Mr. Nam currently serves as the Chief Executive Officer and Chairman of the Board of Directors of DNI, a position he has held since March 1993. Mr. Nam currently serves as a director of TL International Inc. and Capstone Partners Inc. He previously served as the Chief Executive Officer of Korea Ready System and Dasan Engineering Co., Ltd. His work has included export of technical services to Silicon Valley, California since 1999. Mr. Nam served as General Chairman of the International Network of Korean Entrepreneurs from 2004 until 2006, and has served as Director of the Korea Entrepreneurship Foundation since November 2011. Previously, he served as Chairman of the Korean Venture Business Association. Mr. Nam completed his B.E. in Mechanical Engineering from Seoul National University in 1984. We believe Mr. Nam is well suited to serve as the Chairman of our Board of Directors given his extensive experience serving in chief executive officer and chairman roles and his in-depth knowledge of the telecommunications industry.Charles D. Vogt joined DZS as President, Chief Executive Officer and as a director in 2020. A lifelong entrepreneur, Mr. Vogt has spent the past two decades building and leading organizations through high growth and rapid change in challenging and competitive environments. Prior to joining the Company, Mr. Vogt was most recently President, Chief Executive Officer and a Director of ATX Networks, a leader in broadband access and media distribution, where he led the company through extensive transformation and growth since February 2018. From July 2013 to January 2018, Mr. Vogt served as President, Chief Executive Officer and a Director of Imagine Communications, where he directed the company through revolutionary change as it evolved its core technology, including large-scale restructuring and rebranding and multiple technology acquisitions as he implemented a disruptive vision and growth strategy. Before joining Imagine Communications, Mr. Vogt was President, Chief Executive Officer and a Director of GENBAND (today known as Ribbon Communications), where he transformed the company from a startup to the industry’s global leader in voice over IP and real-time IP communications solutions. His professional career has also included leadership roles at Taqua (Tekelec), Lucent Technology (Nokia), Ascend Communications (Lucent), ADTRAN, Motorola and IBM. Mr. Vogt was previously a board member for Stryve Foods, Inc. (NASDAQ: SNAX). Mr. Vogt received his B.S. in Economics and Computer Science from Saint Louis University. We believe Mr. Vogt is well suited to be our Chief Executive Officer and serve on our Board of Directors given his extensive chief executive officer experience, his expertise in the business arena, and his in-depth knowledge of the telecommunications industry.Board Leadership StructureDifferent individuals serve as Chairman of the Board of Directors, Lead Independent Director and Chief Executive Officer. The Chairman is Mr. Min Woo Nam, who presides over meetings of the Board of Directors and the stockholders, reviews and approves meeting agendas, meeting schedules and other information, as appropriate, consults on stockholder engagement and governance matters, and performs such other duties as the Board of Directors requires from time to time. The Lead Independent Director is Mr. David Schopp, who presides over meetings of the Board of Directors at which the Chairman is not present, serves as the principal liaison between the Chairman and the independent directors, reviews and approves meeting agendas, meeting schedules and other information, recommends for selection to the membership and chairman positions for each Board committee and interviews all director candidates, and, as appropriate, consults on stockholder engagement matters. The Chief Executive Officer is Mr. Charles D. Vogt, who focuses on operating and managing the Company. Our Board of Directors believes that this separation of the positions of Chairman, Lead Independent Director and Chief Executive Officer6reinforces the independence of the Board of Directors in its oversight of the business and affairs of the Company, leverages the Chairman’s and Lead Independent Director’s experience and perspectives, and enhances the effectiveness of the Board of Directors as a whole.The Board believes that maintaining a healthy mix of qualified independent, non-management, and management directors on the Board is an integral part of effective corporate governance and management of the Company. The Board also believes that the current leadership structure strikes an appropriate balance between independent directors, management directors, and directors affiliated with DNI, the Company’s largest stockholder, which allows the Board to effectively represent the best interests of the Company’s entire stockholder base. Board IndependenceThe Board of Directors has affirmatively determined that each of Matt W. Bross, Barbara Carbone, Joon Kyung Kim, and David Schopp are independent under the criteria established by The Nasdaq Stock Market, or Nasdaq, for independent board members. At the conclusion of the regularly scheduled Board of Directors meetings, the independent directors have the opportunity to and regularly meet outside of the presence of our management. In addition, each member of the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee is currently an independent director in accordance with Nasdaq standards.Board DiversityThe Board utilizes a thoughtful approach to board composition to ensure that the composition of the Board reflects the Company’s efforts and commitment to achieving diversity, including with respect to age, gender, race and ethnicity. The table below provides certain information regarding the composition of our Board. Each of the categories listed in the table below has the meaning given it in Nasdaq Rule 5605(f).Board Diversity Matrix (as of December 31, 2022) Board Diversity Matrix (as of December 31, 2022) Total Number of Directors 7 Female Male Non-Binary Did Not Disclose Gender Part I: Gender Identity Directors 1 6 Part II: Demographic Background African American or Black Alaskan Native or Native American Asian 3 Hispanic or Latinx Native Hawaiian or Pacific Islander White 1 3 Two or More Races or Ethnicities LGBTQ+ Did Not Disclose Demographic Background Committee CompositionOur Board of Directors has the following four standing committees: (1) Audit Committee, (2) Compensation Committee, (3) Corporate Governance and Nominating Committee and (4) Strategy Committee. The current membership and the function of each of the committees are described below. Each of the committees operates under a written charter that can be found on the “Governance” section of our website at https://investor-dzsi.com/investor.dzsi.com/governance/governance-documentsgovernance-documents/default.aspx.

Committee

Governance and

Nominating

Committee

7

7Director Independence Financial Expert Audit Committee Compensation

Committee Corporate

Governance and

Nominating

CommitteeStrategyCommitteeMatt W. Bross Independent — —

Barbara Carbone Independent

— — Joon Kyung Kim Independent

— Min Woo Nam — — — — —

David Schopp Independent —

—

Choon Yul Yoo — — — — — — Charles D. Vogt — — — — — — Number of Meetings in 2022 7 6 2 1  Member

Member  Chairperson

Chairperson  Financial Expert